The Indian stock market is one of the largest and most active in the world. It comprises two major stock exchanges, the Bombay Stock Exchange (BSE) and the National Stock Exchange (NSE), along with several smaller regional exchanges.

The BSE is the oldest stock exchange in Asia and has been in operation since 1875, while the NSE was established in 1992.

The Indian stock market includes a range of securities such as stocks, bonds, and derivatives. The stock market is regulated by the Securities and Exchange Board of India (SEBI), which is responsible for overseeing market participants, ensuring transparency and fairness, and enforcing rules and regulations.

Investors can invest in the Indian stock market through various instruments such as mutual funds, exchange-traded funds (ETFs), and individual stocks. The Indian stock market offers opportunities for both short-term and long-term investments, and investors can choose from a wide range of sectors, including information technology, healthcare, consumer goods, and financials.

The Indian stock market has witnessed significant growth over the past few decades and has been able to attract both domestic and foreign investors. However, like all stock markets, the Indian stock market is also subject to volatility and risks, and investors should exercise caution and do their research before making any investment decisions.

What factors affect the stock market in India?

There are several factors that can affect the stock market in India, including:

- Economic indicators: Economic indicators such as GDP growth, inflation rates, interest rates, and government policies can have a significant impact on the stock market. For example, if the GDP growth rate is high, it can lead to increased investor confidence and a bullish market sentiment.

- Corporate performance: The performance of individual companies can also impact the stock market. If a company reports strong earnings or makes positive announcements about future growth prospects, its stock price may increase, which can drive up the overall market.

- Global events: International events such as geopolitical tensions, changes in trade policies, or global economic conditions can also affect the stock market in India. For example, if there is a slowdown in the Chinese economy, it can have a negative impact on the Indian stock market, as China is one of India’s largest trading partners.

- Currency exchange rates: Fluctuations in currency exchange rates can also impact the stock market, as it can affect the profitability of companies that operate globally. For example, if the Indian rupee strengthens against the US dollar, it can lead to increased profits for Indian companies that export goods to the US.

- Investor sentiment: Finally, investor sentiment can play a crucial role in the stock market. If investors are optimistic about the future prospects of the market, they may invest more, driving up stock prices. On the other hand, if investors are pessimistic or fearful, they may sell their stocks, leading to a bearish market sentiment.

About the Author

Ankita is a German scholar and loves to write. Users can follow Ankita on Instagram

When is a Nuclear Reactor called Critical?

When Nuclear fuel sustains the fission chain reaction inside a nuclear reactor, the reactor is…

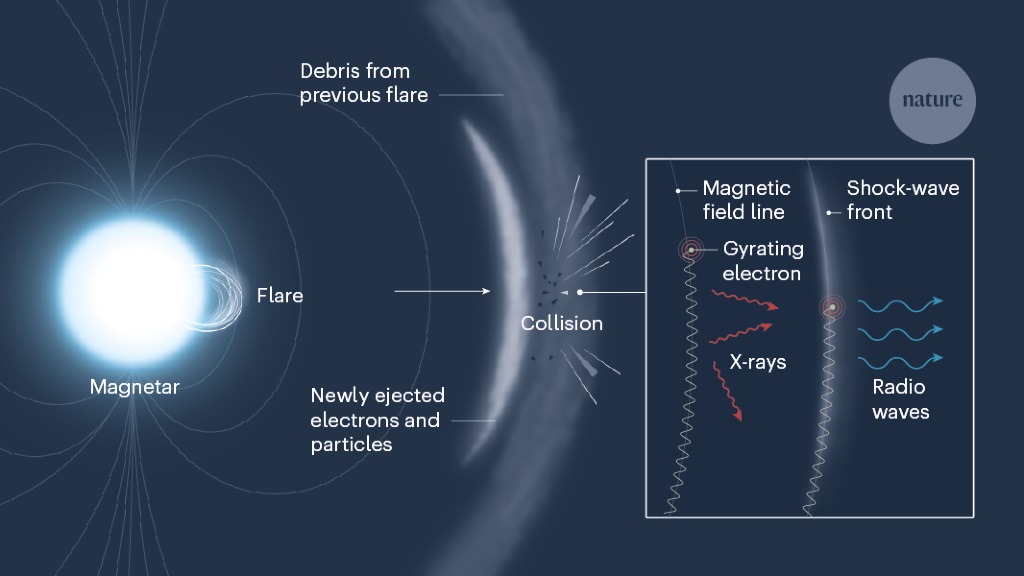

क्या है फास्ट रेडियो बर्स्ट सिग्नल [fast radio burst]?

रेडियोखगोलिकी में तीव्र रेडियो प्रस्फोट (fast radio burst) या ऍफ़॰आर॰बी॰ (FRB) अज्ञात कारणों से उत्पन्न एक बहुत अधिक ऊर्जावान खगोलभौतिक परिघटना होती…

Rao Chandra Sen of Marwar (1562-81)

Emperor Rao Chandra Sen of Marwar ruled with glory from 1562 to 1581. His steadfast…

क्या मुझे आई.ए.एस (IAS) की कोचिंग के लिए दिल्ली जाना चाहिए ?

आई.ए.एस (IAS) की कोचिंग के लिए दिल्ली जाना एक बैहतर विकल्प हो सकता है। दिल्ली…

सवाना या उष्णकटिबंधीय घास मैदान (savanna or tropical grasslands)

सवाना (Savannah) समुदाय घास और बिखरे हुए पेड़ों का एक विशेष पारितंत्र है। सवाना सामान्य…

माइकल फैराडे का जीवन और आविष्कार

अंग्रेजी भौतिक विज्ञानी और रसायनज्ञ माइकल फैराडे (1791-1867) को व्यापक रूप से इतिहास के सबसे…